TL;DR

APAC’s $210B programmatic market is driven by two powerhouse channels—Connected TV (CTV) and Retail Media—that rarely work together. This 3-step playbook shows marketers how to unify both through Display & Video 360 (DV360) for a full-funnel strategy for online shopping events like 11.11, Black Friday, and beyond.

- Step 1: Use premium CTV inventory (Netflix, Viu, BVODs) to build high-intent audiences before the sale.

- Step 2: Combine off-site DV360 commerce audiences with on-site retail ads on platforms like Shopee and Lazada to maximise conversions.

- Step 3: Re-engage viewers and purchasers post-sale to drive repeat sales during 12.12 and Christmas.

The key: Don’t treat each sales event as a campaign reset—treat them as connected moments powered by data, measurement, and automation in DV360.

If you’re a marketer in the APAC region, you have weeks—maybe only days—until the most critical sales period of the year.

The APAC programmatic market is a $210 billion opportunity, but it’s being driven by two channels that don’t talk to each other: Connected TV (CTV) and Retail Media (Mordor Intelligence, 2025). Here is the 3-step strategy to unify them for this holiday season via targeting and inventory solutions in Display and Video 360 (DV360).

Step 1 (Pre-Sale): Build Awareness with Premium CTV

Your Goal: Build a high-quality audience pool before the sales hit.

Stop thinking of CTV as just a “brand” play. It is now the single most powerful tool for building high-intent retargeting lists. While your competitors are fighting for expensive, low-quality audiences during the 11.11 chaos, you will be activating a pre-built, high-engagement pool of users you’ve already warmed up.

The “Where”:

You must go where your audience is. This means moving beyond just YouTube and buying inventory on the premium platforms that dominate your specific market.

- For AUNZ: This means buying Netflix, which is now available programmatically in DV360, alongside the major broadcaster VOD (BVOD) platforms like 9Now and 7plus (Google, 2024).

- For SEA: This means securing inventory on the regional OTT leaders your audience is binging right now, such as Viu, iQIYI, and Samsung Ads for Smart TV households.

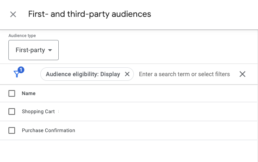

The Action: Launch awareness campaigns on these platforms now. Use DV360’s measurement tools to track who watches, then place them into a “CTV-Viewed” audience segment for Step 2.

Step 2 (During Sale): Convert with a Unified Retail Media Strategy

Your Goal: Convert high-intent shoppers and capture sales during the peak 48-hour sales window.

This requires a two-pronged attack:

2.1 The “Off-site” (Open Web) Strategy:

This is where you convert users who are browsing other sites. Using DV360’s “Commerce Audience” integrations (from partners like Criteo), you can target users based on real-time, granular purchase intent, such as “in-market for air fryers” or “abandoned a cart on a competitor site” (Criteo, 2025). You use this to drive them to your sales page.

2.2 The “On-site” (Walled Garden) Strategy:

This is the most critical, bottom-of-funnel battleground. You must be visible on the e-commerce platforms themselves. This means running sponsored product ads directly within platforms like Shopee and Lazada, which are key market drivers (Dentsu, 2025). While these are bought natively (outside DV360), they are essential. Your DV360 “off-site” campaign drives the user, and your “on-site” Shopee Ad closes the deal.

Important Note: In terms of a long term campaign strategy, FiveStones generally recommends using your website as the landing page (versus an ecommerce platform). Having your website as a landing page allows you to implement tags to build an audience list for future/current campaign optimization.

Step 3 (Post-Sale): Re-engage for 12.12 & Christmas

Your Goal: Win back non-converters and drive repeat purchases.

The end-of-year sales season isn’t one event; it’s a rolling campaign. As an example, your most valuable asset from 11.11 is the data you just collected.

- For CTW Audiences: Activate your "CTV-Viewed" audience from Step 1. Target the users who saw your ad with a special "Welcome Back" offer for 12.12.

- For New/Existing Customers: Create a new audience segment of "11.11 Purchasers" based on collected first party data. Re-engage them for Christmas with a "Thank You" offer to drive loyalty and a second purchase.

Conclusion

The APAC holiday season is not just about grabbing that second-lasting attention —it’s about connecting your media investments across every screen and shopping moment. By synchronising Connected TV and other inventory types within DV360, marketers can create a single, measurable journey from awareness to conversion, instead of fragmented bursts of activity.

FAQ

- Why should I use CTV for performance campaigns?

CTV isn’t just an awareness channel anymore. With DV360 and other Google Marketing Platform solutions like GA4, you can measure viewer engagement, build first-party “CTV-Viewed” audiences, and retarget them during sale periods—turning top-funnel awareness into mid- and bottom-funnel performance. - Can I buy Netflix or BVOD inventory directly in DV360?

Yes. Netflix and major BVOD platforms like 9Now and 7plus in Australia are now available programmatically in DV360, allowing you to run high-quality awareness campaigns with measurable outcomes. - What are “Commerce Audiences” in DV360?

These are intent-based audience segments powered by commerce partners like Criteo. You can target users actively shopping or browsing specific product categories (e.g., “in-market for air fryers”), ideal for 11.11 and Black Friday campaigns. - Should I drive traffic to my website or my Shopee/Lazada store?

For long-term audience building, it’s best to drive traffic to your own website, where DV360 tags can capture valuable audience data for future remarketing. - How can I prepare for 12.12 and Christmas after 11.11?

Use your 11.11 campaign data to segment non-converters and new customers. Then, re-engage them with personalised offers via CTV and display retargeting—turning one-time shoppers into repeat buyers.

Sources:

- Criteo (2025). “Built Different: Commerce Affinity Audiences.” https://www.criteo.com/blog/built-different-commerce-affinity-audiences/

- Dentsu (2025). “Ad Spend Report: Asia Pacific Defies Global Slowdown.” https://www.dentsu.com/sg/en/our-news/dentsu-ad-spend-report-asia-pacific-defies-global-slowdown-with-strong-forecast-for-2025

- Gartner (2024). “Gartner Predicts Search Engine Volume Will Drop 25% by 2026.” https://www.gartner.com/en/newsroom/press-releases/2024-02-19-gartner-predicts-search-engine-volume-will-drop-25-percent-by-2026-due-to-ai-chatbots-and-other-virtual-agents

- Google (2024, March). “New ways to measure and perform on Connected TV.” Google Marketing Platform Blog. https://blog.google/products/marketingplatform/display-video-360/connected-tv-measurement-performance-upgrades/

- Google (2024, July). “Reach the Netflix audience on Display & Video 360.” Google Marketing Platform Blog. https://blog.google/products/marketingplatform/display-video-360/netflix-display-video-360/

- Mordor Intelligence (2025). “Asia-Pacific Programmatic Advertising Market.” https://www.mordorintelligence.com/industry-reports/asia-pacific-programmatic-advertising-market